One of the major story lines over the last year is how well the residential real estate market performed. One key metric in the spotlight is home price appreciation. According to the latest indices, home prices are skyrocketing this year.

Here are the latest percentages showing the year-over-year increase in home price appreciation:

- The House Price Index (HPI) from the Federal Housing Finance Agency (FHFA): 18.8%

- The S. National Home Price Index from S&P Case-Shiller: 18.6%

- The Home Price Insights Report from CoreLogic: 18%

The dramatic increases are seen at every price point and in all regions of the country.

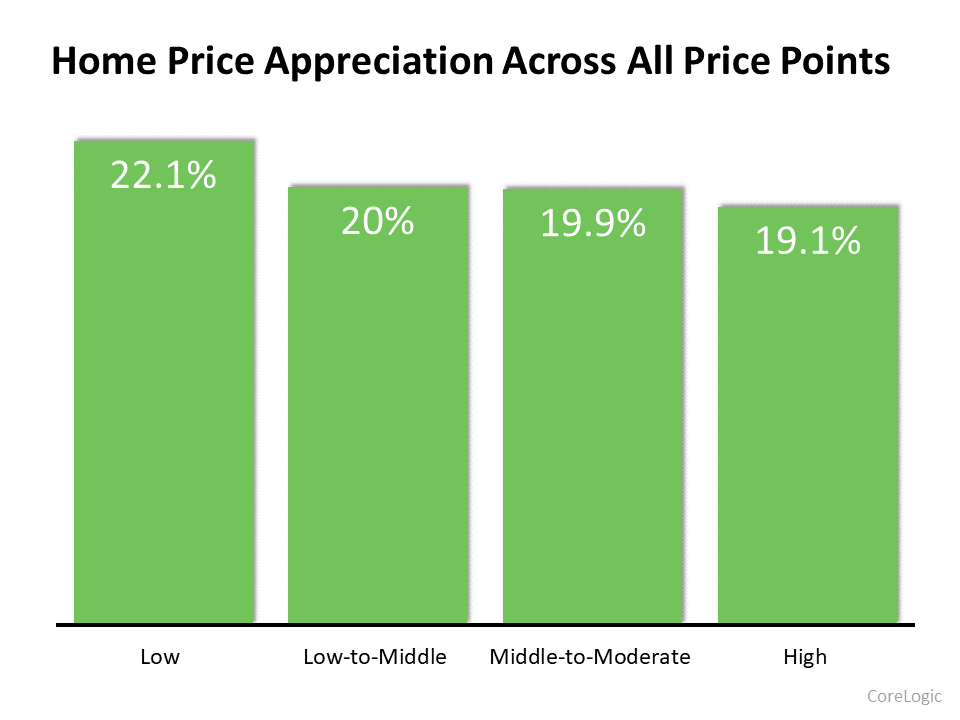

Increases Are Across Every Price Point

According to the latest Home Price Index from CoreLogic, each price range is seeing at least a 19% increase year-over-year:

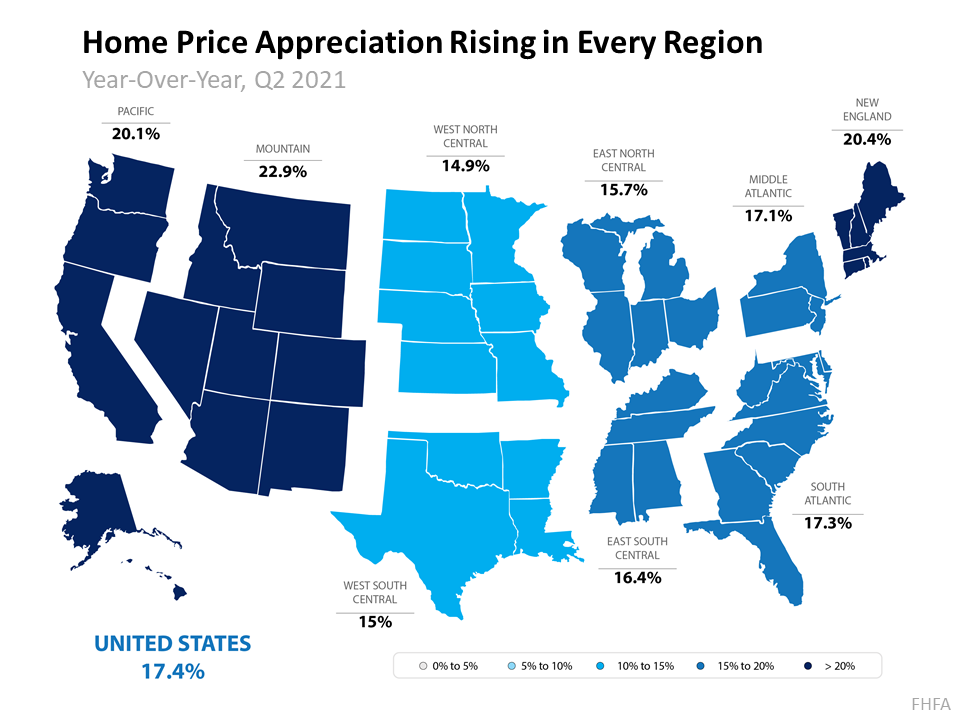

Increases Are Across Every Region in the Country

Every region in the country is experiencing at least a 14.9% increase in home price appreciation, according to the Federal Housing Finance Agency (FHFA):

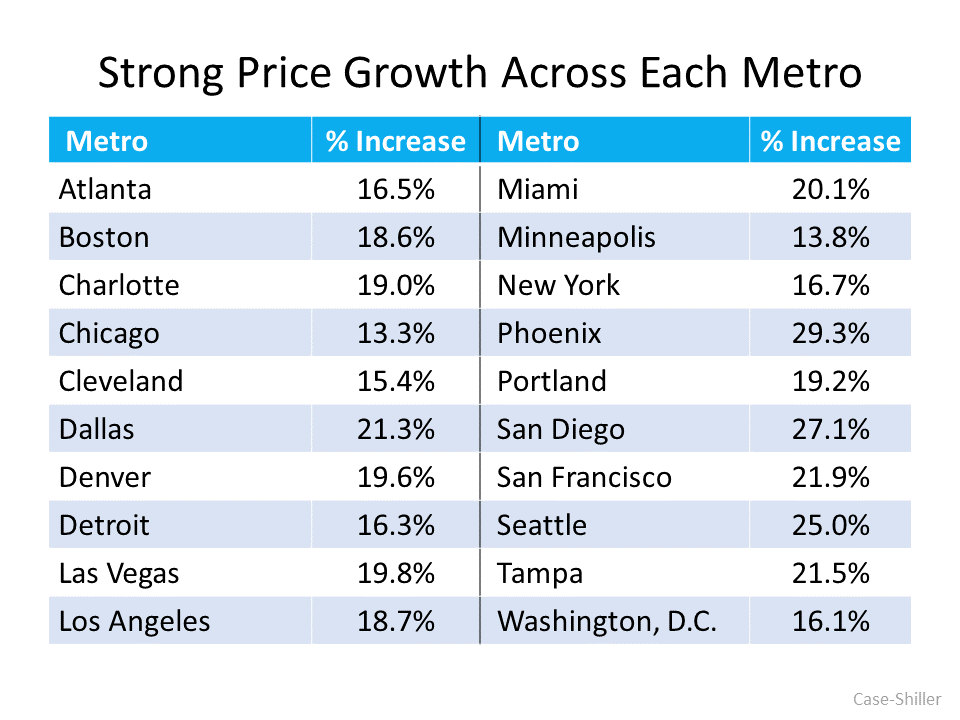

Increases Are Across Each of the Top 20 Metros in the Country

According to the U.S. National Home Price Index from S&P Case-Shiller, every major metro is seeing at least a 13.3% growth in prices (see graph below):

What About Price Appreciation in 2022?

Prices are the result of the balance between supply and demand. The demand for single-family homes has been strong over the last 18 months. The supply of houses available for sale was near historic lows. However, there’s some good news on the supply side. Realtor.com reports:

“432,000 new listings hit the national housing market in August, an increase of 18,000 over last year.”

There will, however, still be a shortage of supply compared to demand in 2022. CoreLogic reveals:

“Given the widespread demand and considering the number of standalone homes built during the past decade, the single-family market is estimated to be undersupplied by 4.35 million units by 2022.”

Yet, most forecasts call for home price appreciation to moderate in 2022. The Home Price Expectation Survey, a survey of over 100 economists, investment strategists, and housing market analysts, calls for a 5.12% appreciation level next year. Here are the 2022 home appreciation forecasts from the four other major entities:

- The National Association of Realtors (NAR): 4.4%

- The Mortgage Bankers Association (MBA): 8.4%

- Fannie Mae: 5.1%

- Freddie Mac: 5.3%

Price appreciation is expected to slow in 2022 when compared to the record highs of 2021. However, it is still expected to be greater than the annual average of 4.1% over the last 25 years.

Bottom Line

If you owned a home over the past year, you’ve seen your household wealth grow substantially, and you’ll see another nice boost in 2022. If you’re thinking of buying, consider buying now as prices are forecast to continue increasing through at least next year.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Paulo Rodriguez and/or related companies do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Paulo Rodriguez and/or related companies will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.