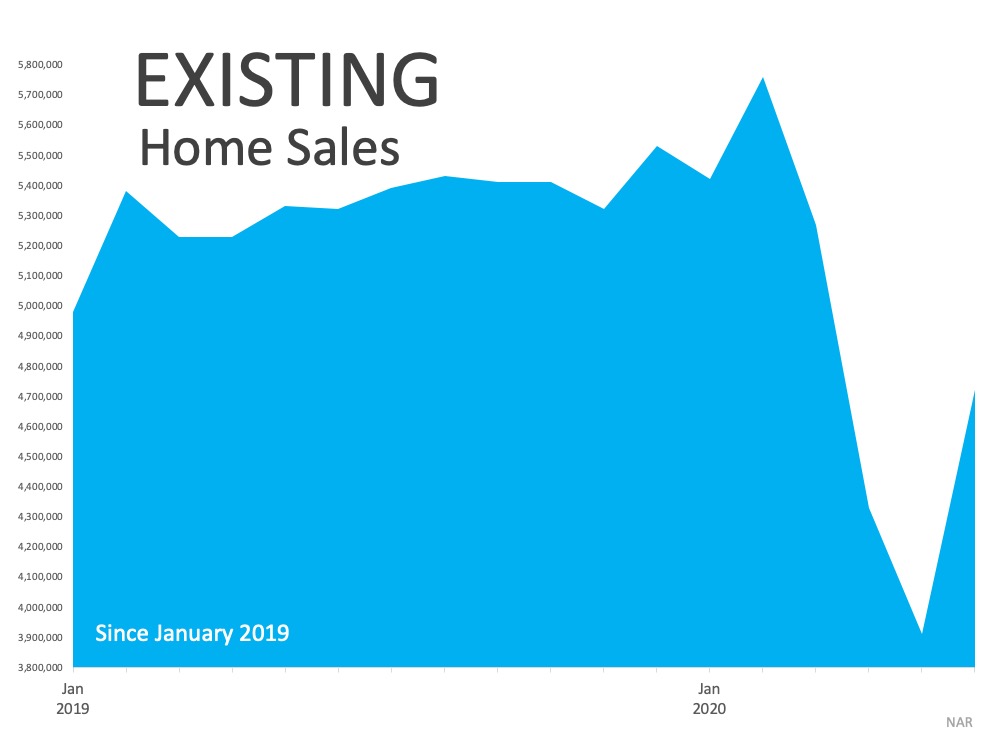

With a worldwide health crisis that drove a pause in the economy this year, the housing market was greatly impacted. Many have been eagerly awaiting some bright signs of a recovery. Based on the latest Existing Home Sales Report from the National Association of Realtors (NAR), June hit a much-anticipated record-setting rebound to ignite that spark.

According to NAR, home sales jumped 20.7% from May to a seasonally-adjusted annual rate of 4.72 million in June:

“Existing-home sales rebounded at a record pace in June, showing strong signs of a market turnaround after three straight months of sales declines caused by the ongoing pandemic…Each of the four major regions achieved month-over-month growth.”

This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too:

This significant rebound is a major boost for the housing market and the U.S. economy. According to Lawrence Yun, Chief Economist for NAR, the momentum has the potential to continue on, too:

“The sales recovery is strong, as buyers were eager to purchase homes and properties that they had been eyeing during the shutdown…This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue.”

With mortgage rates hitting an all-time low, dropping below 3% for the first time last week, potential homebuyers are poised to continue taking advantage of this historic opportunity to buy. This fierce competition among buyers is contributing to home price increases as well, as more buyers are finding themselves in bidding wars in this environment. The report also notes:

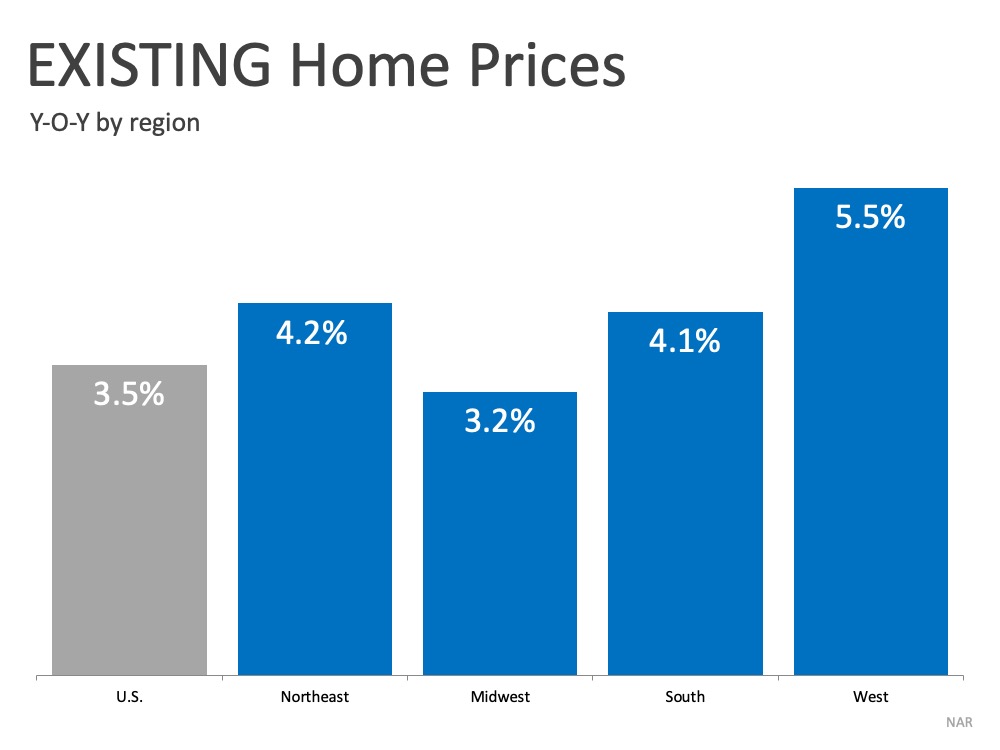

“The median existing-home price for all housing types in June was $295,300, up 3.5% from June 2019 ($285,400), as prices rose in every region. June’s national price increase marks 100 straight months of year-over-year gains.”

The graph below shows home price increases by region, powered by low interest rates, pent-up demand, and a decline in inventory on the market: Yun also indicates:

Yun also indicates:

“Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.”

Bottom Line

Buyers returning to the market is a great sign for the economy, as housing is still leading the way toward a recovery. If you’re ready to buy a home this year, let’s connect to make sure you have the best possible guide with you each step of the way.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Paulo Rodriguez and/or related companies do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Paulo Rodriguez and/or related companies will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.