Keeping a low mortgage rate feels smart – until it starts holding you back.

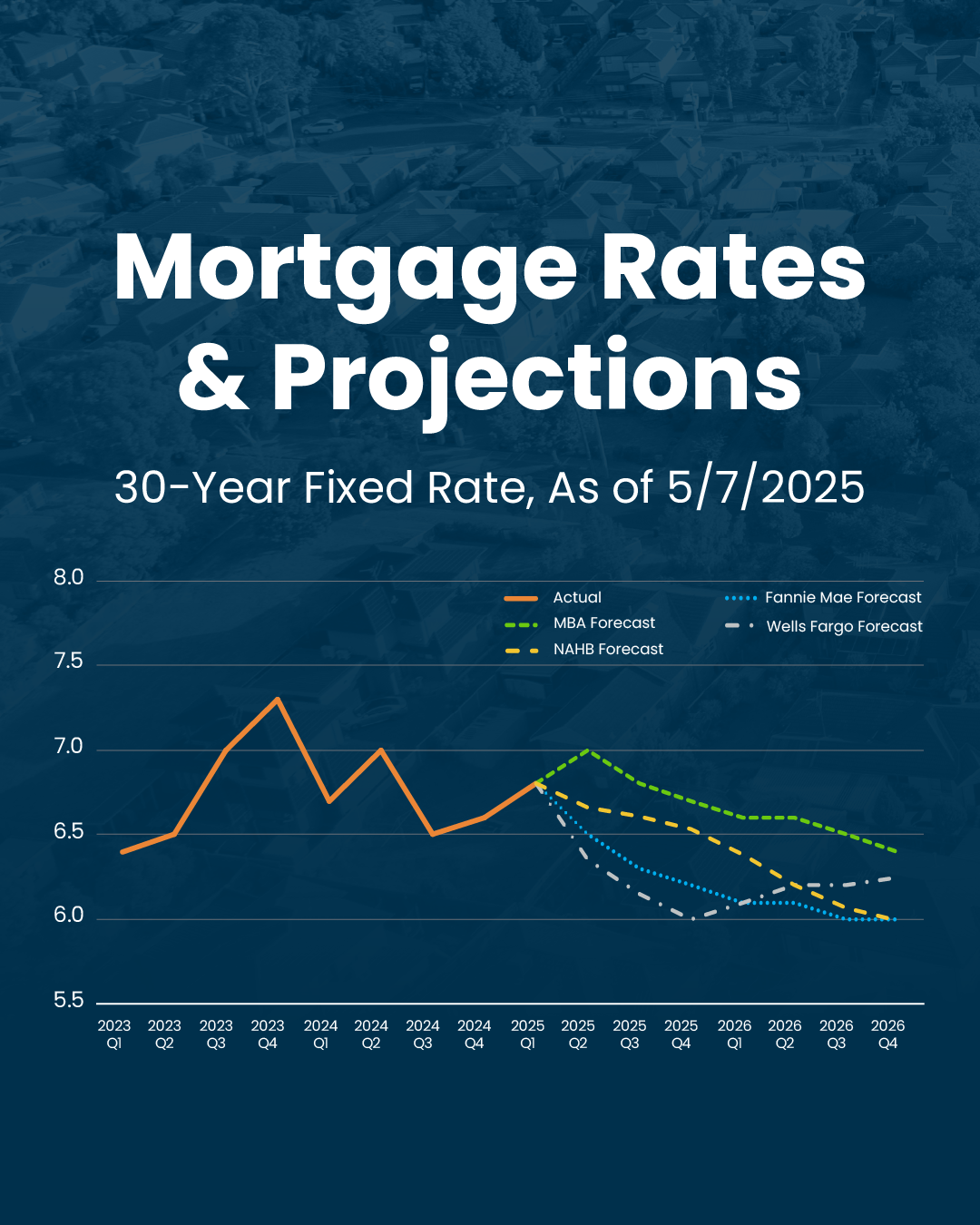

Because here’s the thing you may not realize. Rates aren’t expected to fall as much as you want them to.

Expert forecasts show mortgage rates will still be between 6-6.5% by the end of 2026. So, if you’re waiting for the return of 3%, it’s not in the cards. So why hold out for something that’s probably not going to happen?

Instead, ask yourself this: What are the chances you’ll still be in your current house 5 years from now?

Because if a life change is coming (or if it’s already happened), your house may need to change too – no matter where rates are. Let’s talk about what makes sense for your timeline and how to plan ahead.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Paulo Rodriguez and/or related companies do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Paulo Rodriguez and/or related companies will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.